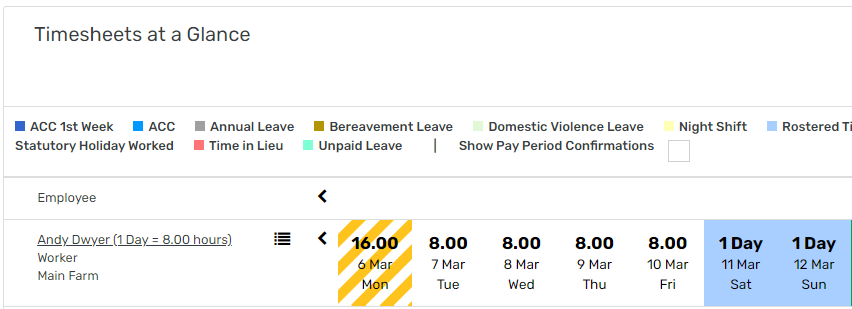

1. On the Dashboard, scroll down to Timesheets at a Glance. Here you can see if anything looks out of place e.g. excessive hours recorded on any given day for an employee:

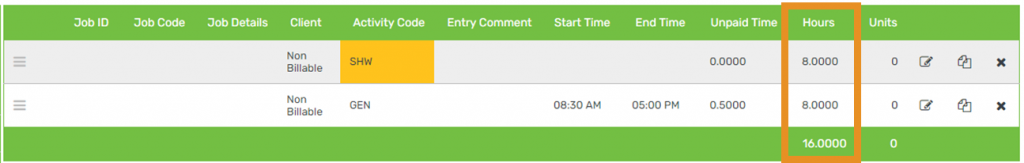

2. To review a timesheet further, click on the applicable entry to go to the actual timesheet:

3. Hover on Reports > Timesheet Report

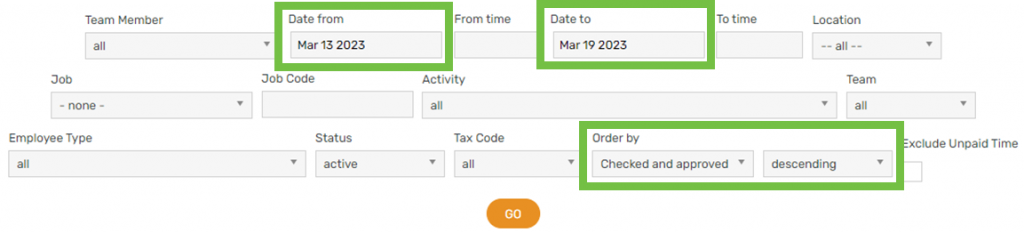

4. Select Date from > select Date to > update Order by to Checked and approved > update ascending to descending > GO:

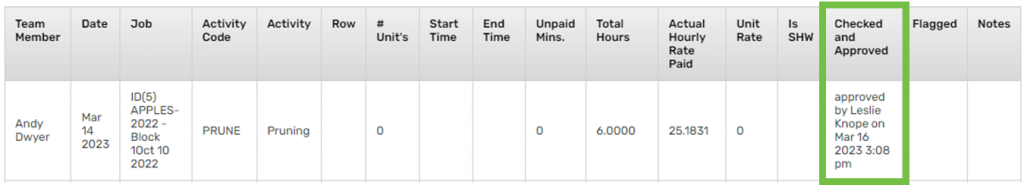

5. Review the Checked and Approved column. If the hours have been checked and approved, this will be indicated by a timestamp in the column:

If any hours haven’t been checked and approved, stop here until this has been done:

6. Hover on Reports > Unit Remuneration Report

7. Select the date range > GO

8. Review the pay data for all employees

9. Hover on Reports > Job Cost to Salary & Wages Paid Reconciliation

10. Select the date range > GO

11. Scroll down to the bottom of the page and click All (if there’s more than 50 employees)

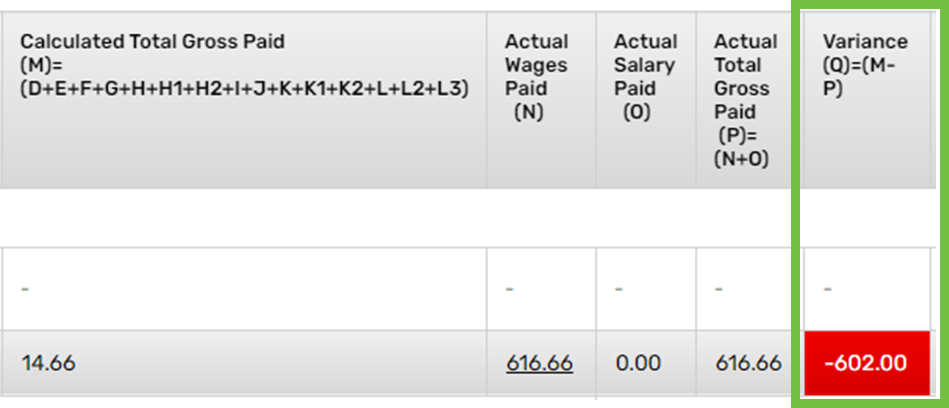

12. Investigate any discrepancies in the Variance column (column Q). These will be highlighted in red:

If there are discrepancies in the Variance column, follow the below steps:

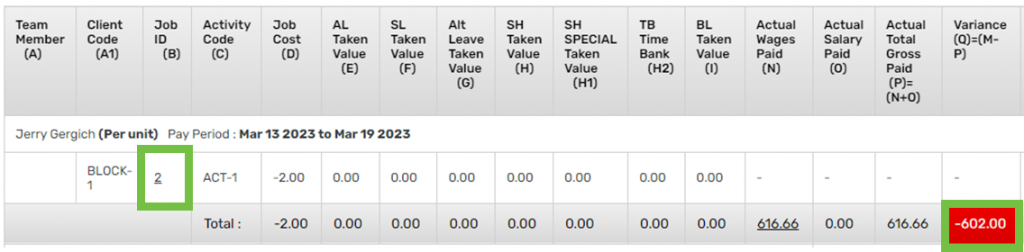

a. Click the Job ID (in line with the red variance):

This will open the Job Costing Report in a new tab

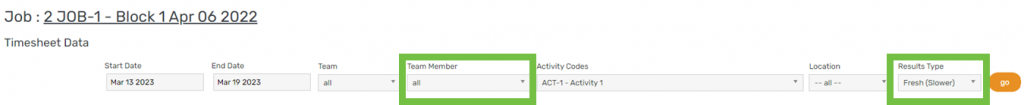

b. Select All in the Team Member field > select Fresh (Slower) in the Results Type field > then click GO:

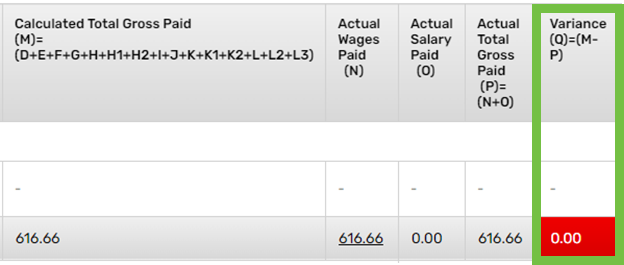

c. Once the report has loaded, close the Job Costing Report tab and go back to the Job Cost to Salary & Wages Paid Reconciliation tab:

d. Refresh the Job Cost to Salary & Wages Paid Reconciliation tab – the Variance should have cleared:

e. Repeat for all variances

f. Scroll down to the bottom of the page and check the Sub Total of the Variance column. This should be nil (or very close to it due to rounding)

g. If there’s still a variance, contact us on 0800 110 172 / support@agrismart.co.nz