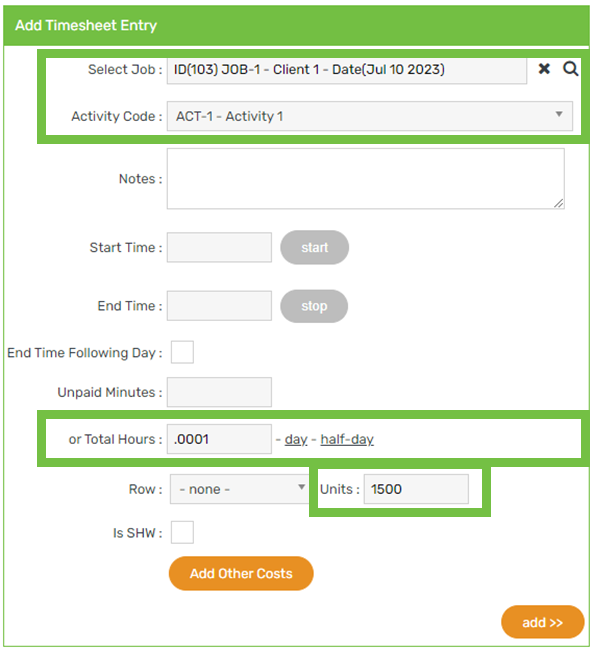

1. Create a timesheet for the contractor just as you would for an employee and select a Job (optional) and Activity Code. For help on this, click here

2. Ignore the Start Time and End Time fields and enter 0.0001 in the Total Hours field

3. Enter the Units e.g. 1500 (this should match the gross amount that the contractor is to receive)

4. Save the entry

Below is an example:

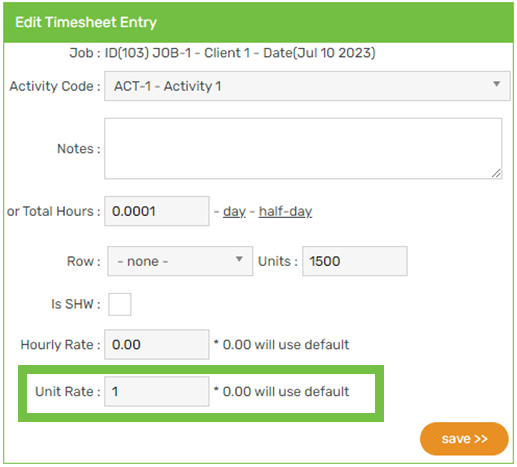

5. Edit the timesheet and enter a Unit Rate e.g. 1 (1500 units per step 3 x 1 = $1,500.00 which is the gross amount the contractor is to receive). For help on editing a timesheet, click here:

6. Save the entry

7. Run the pay for the contractor

8. To account for the GST component, add this as a non-taxable allowance in step 4 of the Payroll Wizard. For help on this, click here