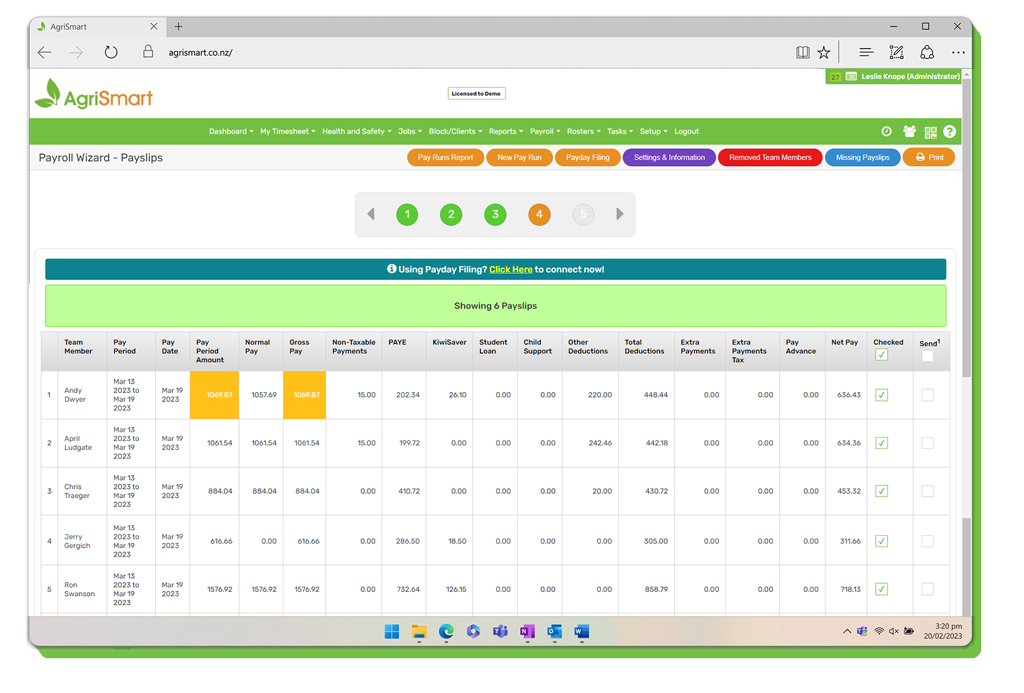

1. Process your pay as normal via the Payroll Wizard, until you get to Step 4. (For help on this, refer to the ‘Process a Pay Run’ help documentation.)

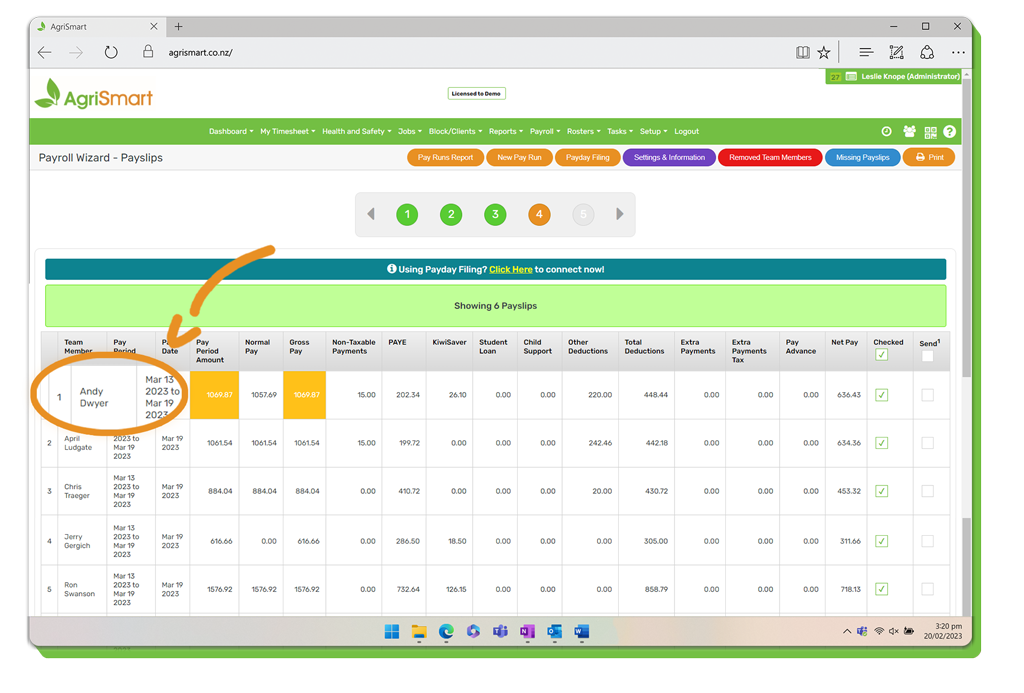

2. Click on the applicable team member to bring up their payslip:

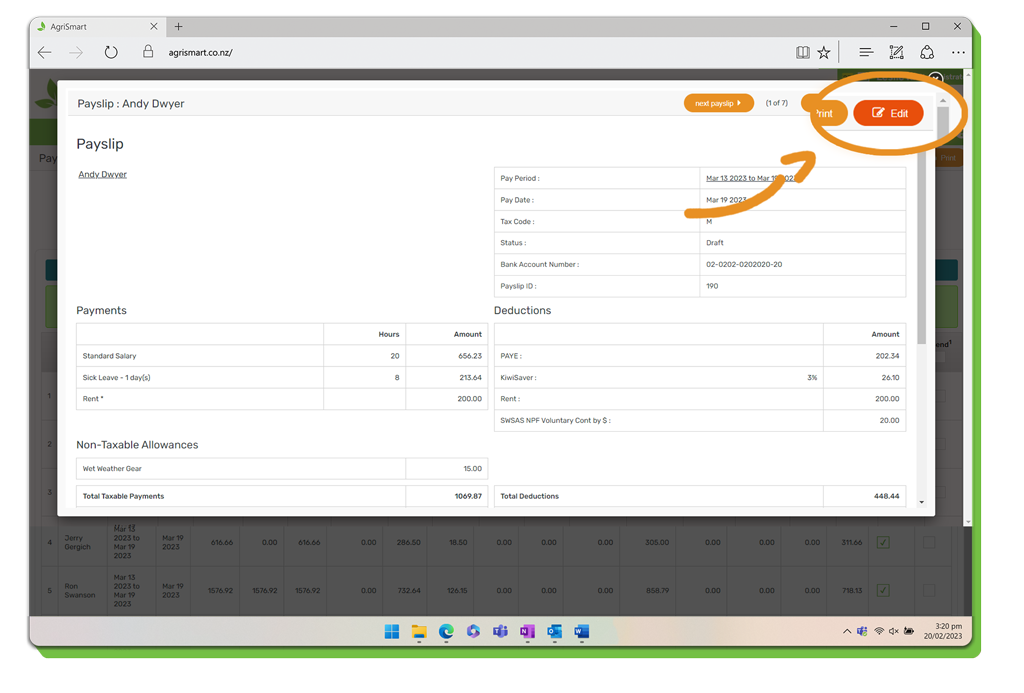

3. Click ‘Edit’ (this will make areas on the payslip editable):

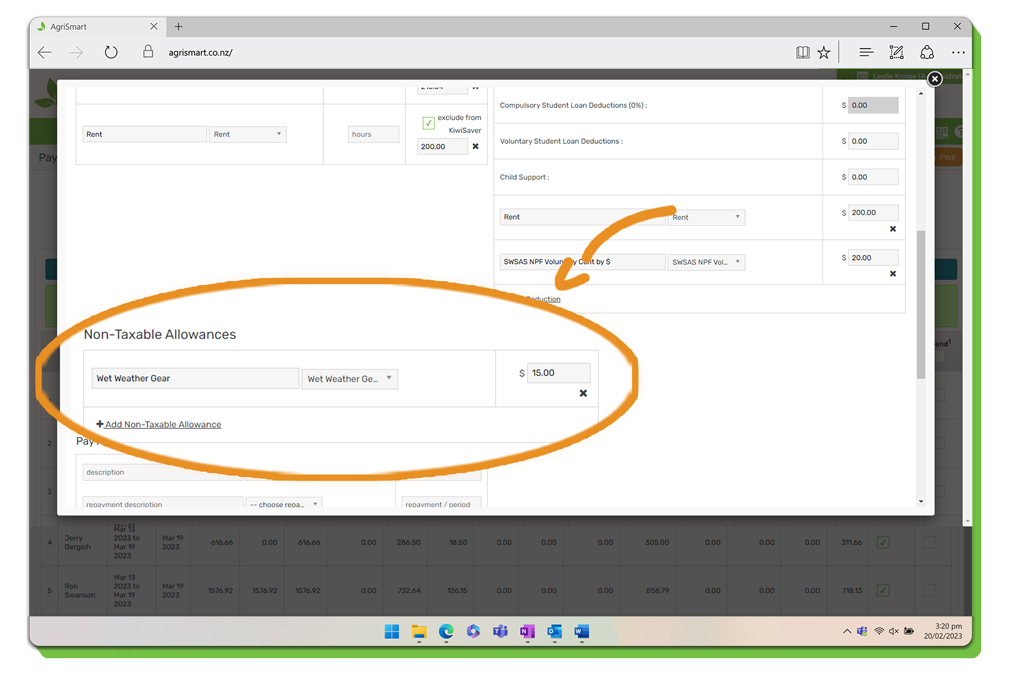

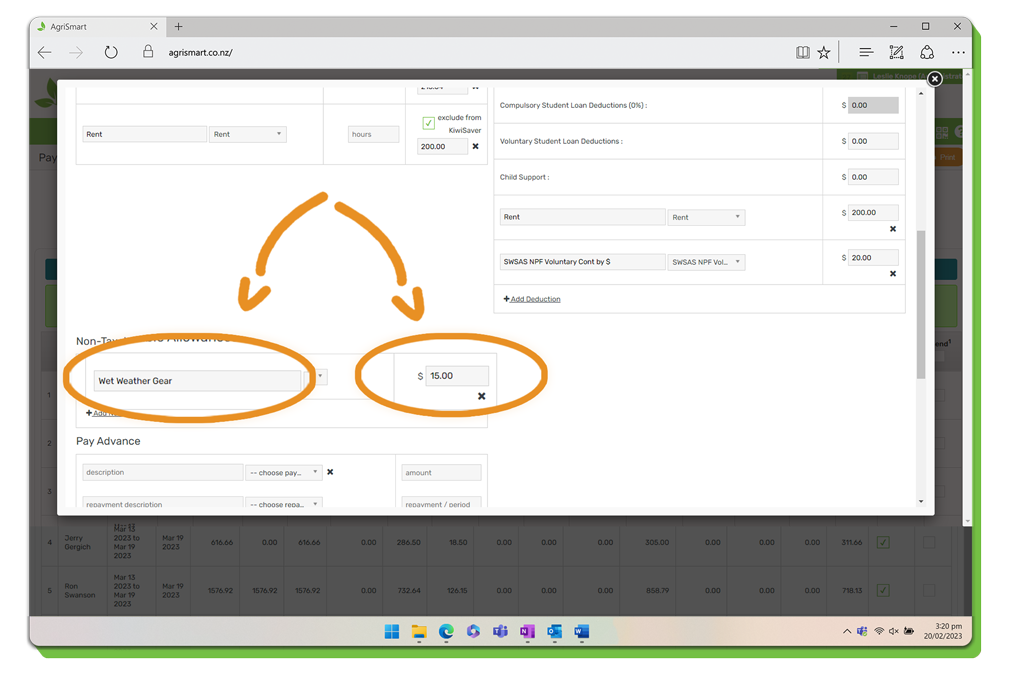

4. Scroll down to the ‘Non-Taxable Allowances’ section:

5. (Note: If you are only wishing to add a one-off non-taxable allowance ignore this step and move onto Step 6) To edit an existing non-taxable allowance, simply adjust the amount and/or description:

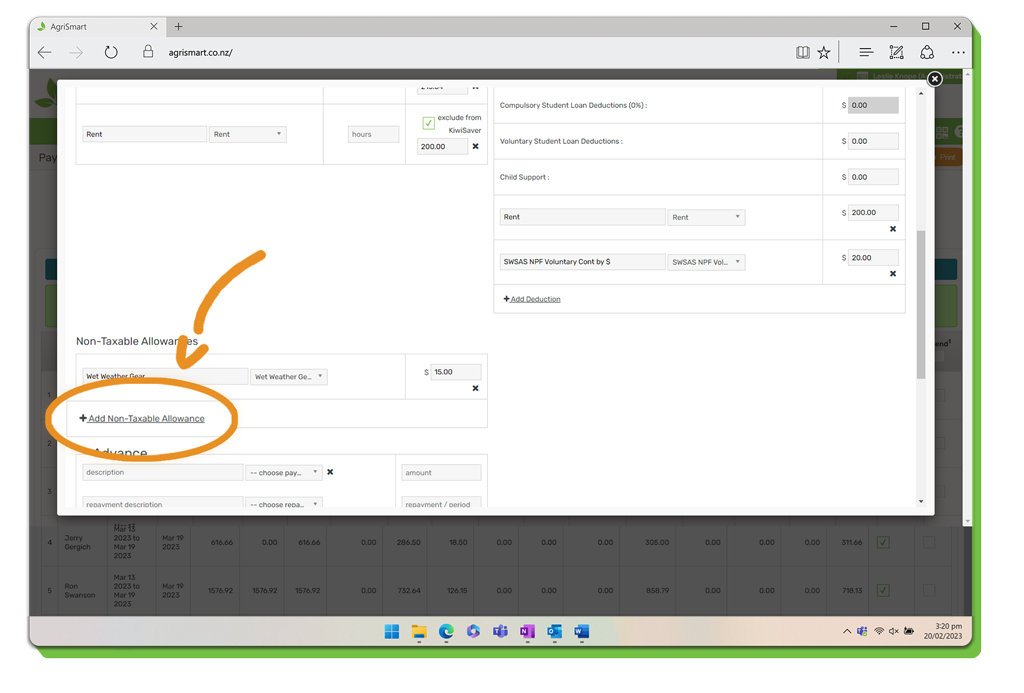

6. (Note: If you made changes to an existing non-taxable allowance using step 5, ignore this step and move onto step 8) To add a one-off non-taxable allowance, click ‘Add Non-Taxable Allowance’:

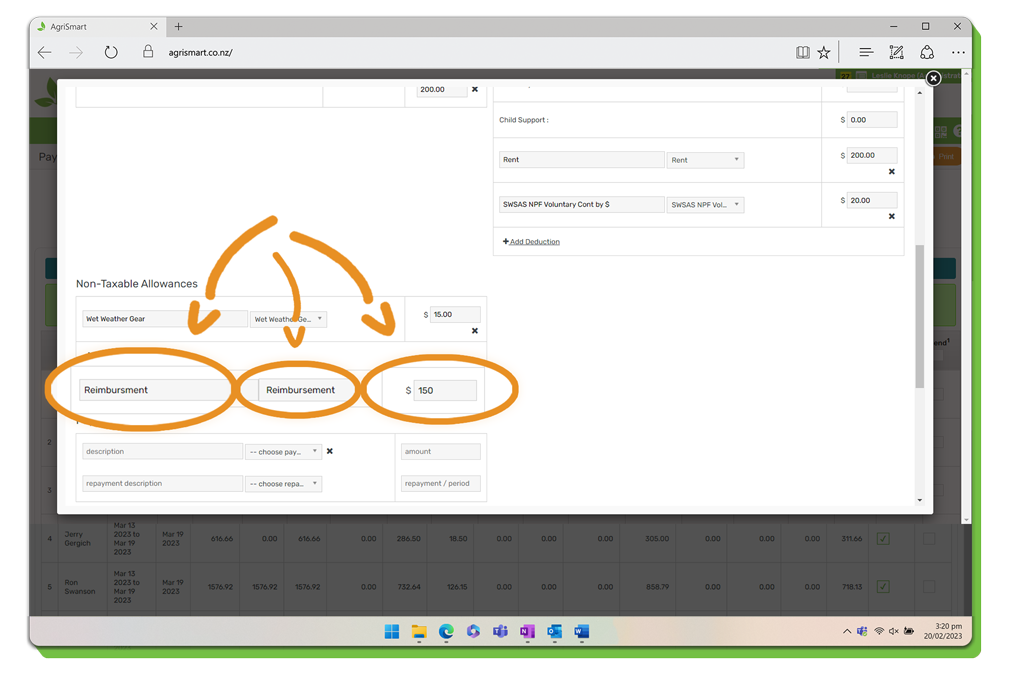

7. Enter in the ‘Description’, ‘Category (optional), and ‘Amount’:

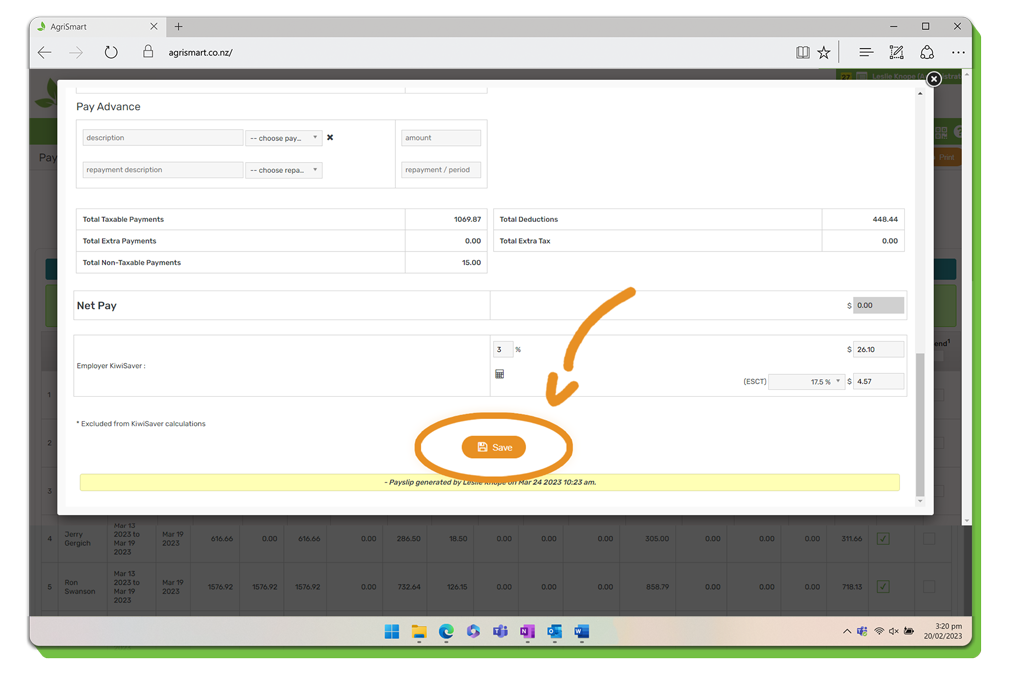

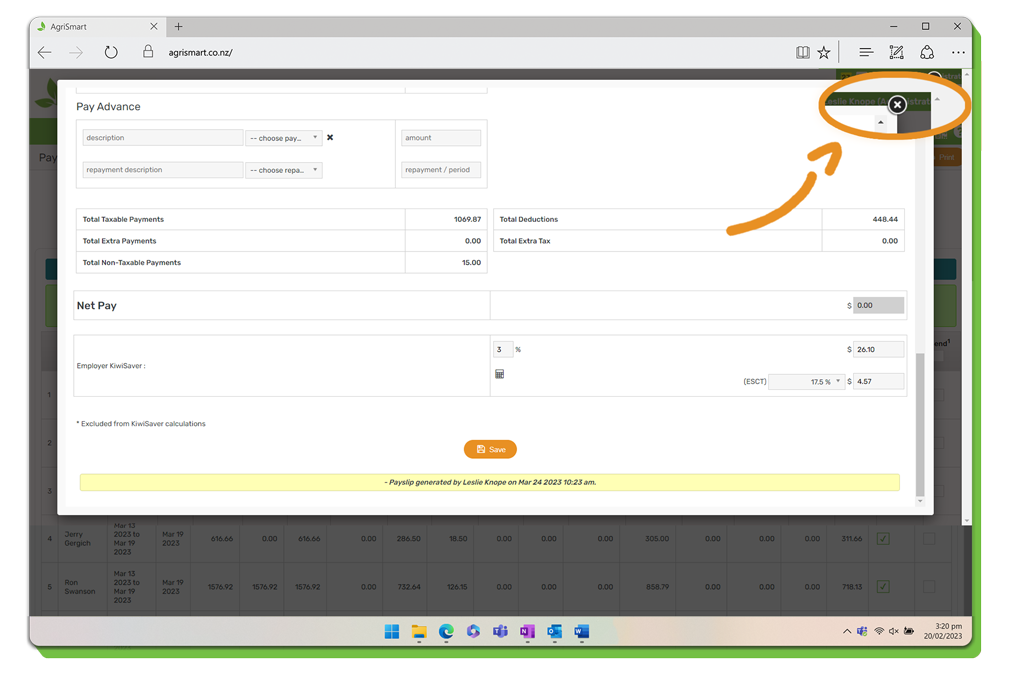

8. Once completed, scroll down to the bottom of the payslip and click ‘Save’:

9. Exit out of the payslip:

10. You can now complete your pay run as normal. (For help on this, refer to the ‘Processing a Pay Run’ help documentation.)