Individual

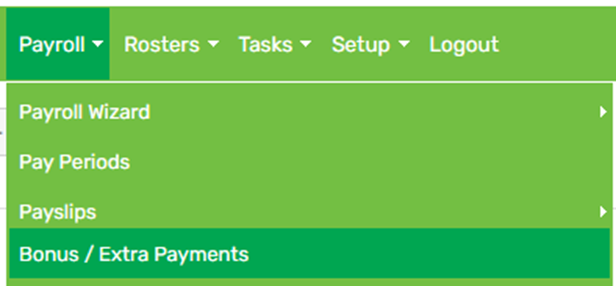

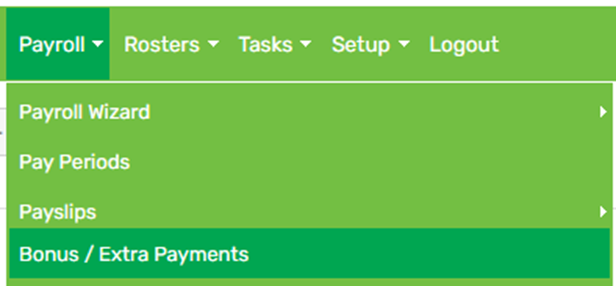

1. Hover on Payroll > click Bonus / Extra Payments:

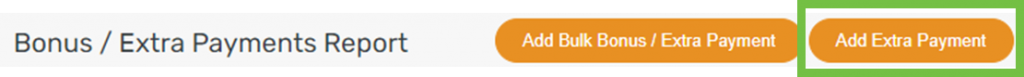

2. Click Add Extra Payment:

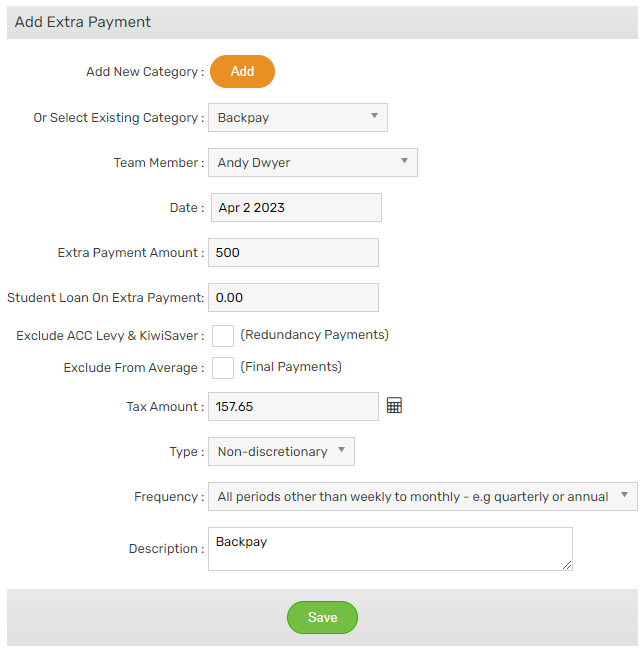

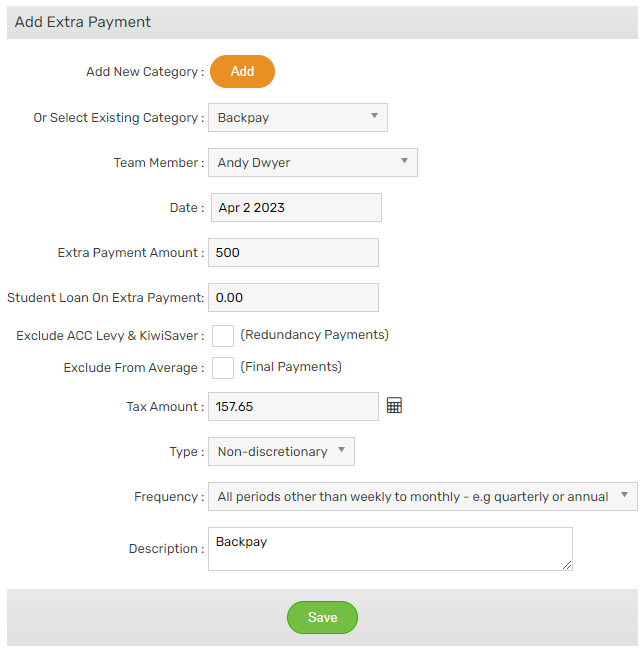

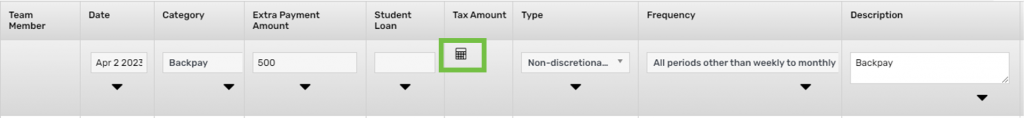

3. Enter the extra payment details > then click Save:

- Add new category / select existing category – For GL purposes

- Team member – Select from the dropdown

- Date – Enter a date within the pay period it’s intended for. For instance, if the pay run is from 27/03-02/04, the date should fall within that period

- Extra payment amount – The extra amount the employee is receiving

- Student loan – No action required here as this will get calculated at a later stage if applicable

- Exclude ACC levy & KiwiSaver / Exclude from Average – Only tick if required

- Tax amount – Click the calculator icon to calculate the tax on the extra payment. If the employee has a student loan, this will be automatically calculated at this stage as well

- Type – Discretionary: Given at the sole discretion of the employer e.g. Christmas bonus

Non-Discretionary: Contractually obligated to pay e.g. Backpay - Frequency – Weekly to monthly: Regular extra payment e.g. monthly bonus

All periods other than: Irregular extra payment e.g. backpay - Description – This is what will be displayed on the payslip

During pay run

1. Get to step 3 of your pay run. For help on this, click here

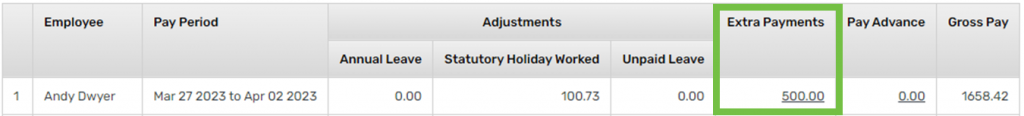

2. Click the relevant row in the Extra Payments column:

3. Enter the extra payment details > then click Save:

- Add new category / select existing category – For GL purposes

- Team member – Change if required

- Date – Enter a date within the pay period it’s intended for. For instance, if the pay run is from 27/03-02/04, the date should fall within that period

- Extra payment amount – The extra amount the employee is receiving

- Student loan – No action required here as this will get calculated at a later stage if applicable

- Exclude ACC levy & KiwiSaver / Exclude from Average – Only tick if required

- Tax amount – Click the calculator icon to calculate the tax on the extra payment. If the employee has a student loan, this will be automatically calculated at this stage as well

- Type – Discretionary: Given at the sole discretion of the employer e.g. Christmas bonus

Non-Discretionary: Contractually obligated to pay e.g. Backpay - Frequency – Weekly to monthly: Regular extra payment e.g. monthly bonus

All periods other than: Irregular extra payment e.g. backpay - Description – This is what will be displayed on the payslip

4. Complete your pay run as normal. For help on this, click here

Import

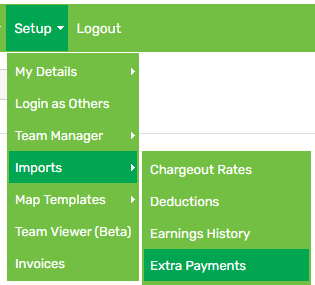

1. Hover on Setup > Imports > click Extra Payments:

2. Click Download template:

3. Complete the downloaded template with relevant information (all fields are compulsory). Example shown below:

- IRD number / Employee code – Choose one or the other

- Date – Enter a date within the pay period it’s intended for. For instance, if the pay run is from 27/03-02/04, the date should fall within that period

- Category – For GL purposes

- Amount – The extra amount the employee is receiving

- Type – Discretionary: Given at the sole discretion of the employer e.g. Christmas bonus

Non-Discretionary: Contractually obligated to pay e.g. Backpay - Frequency – Weekly to monthly: Regular extra payment e.g. monthly bonus

All periods other than: Irregular extra payment e.g. backpay - Description – This is what will be displayed on the payslip

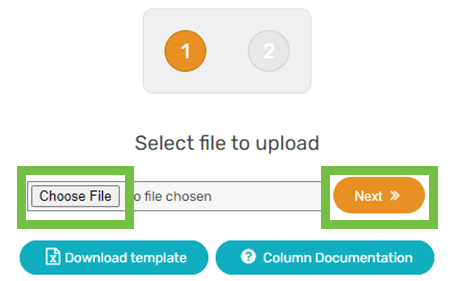

4. Upload the completed template by clicking Choose File > Next:

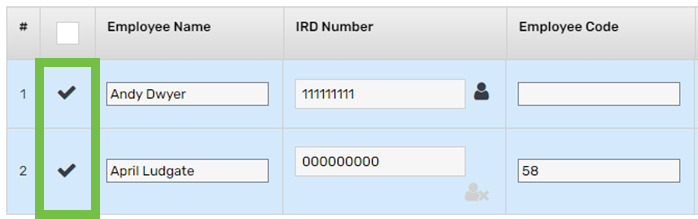

5. Review the information, check the tick box, then click Save:

Bulk

1. Hover on Payroll > click Bonus / Extra Payments:

2. Click Add Bulk Bonus / Extra Payment:

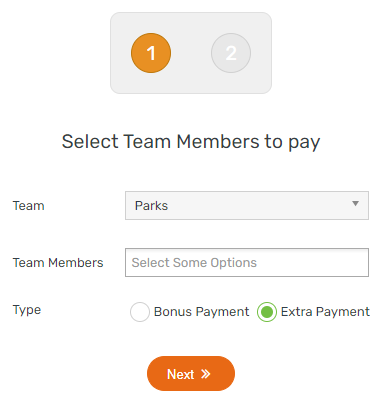

3. Choose a Team and/or Team Members, select Extra Payment, then click Next:

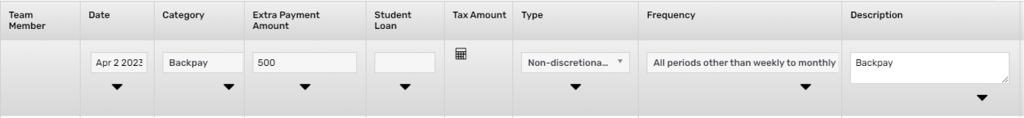

4. Set the extra payment up:

- Date – Enter a date within the pay period it’s intended for. For instance, if the pay run is from 27/03-02/04, the date should fall within that period

- Category – For GL purposes

- Extra payment amount – The extra amount the employees are receiving

- Student loan – No action required here as this will get calculated at a later stage if applicable

- Tax amount – No action required at this stage

- Type – Discretionary: Given at the sole discretion of the employer e.g. Christmas bonus

Non-Discretionary: Contractually obligated to pay e.g. Backpay - Frequency – Weekly to monthly: Regular extra payment e.g. monthly bonus

All periods other than: Irregular extra payment e.g. backpay - Description – This is what will be displayed on the payslip

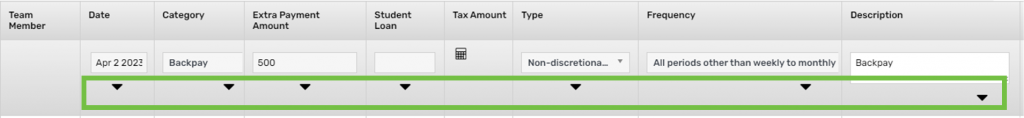

5. Click each arrow:

6. Click the calculator icon. If the employee has a student loan, this will be automatically calculated at this stage as well:

7. Scroll down to the bottom of the page and click Save